As

the holiday season approaches, stress levels can increase significantly,

which can then easily spill over into your trading. It's so important to be in the right frame of mind to trade, and

I've had first hand experience with NOT following this basic and common sense rule. Combine elevated stress with additional external factors, and your flash point can be easily reached -- just

like what recently happened to me.

Tuesday 12/20: -13.00 (OUCH!)

On Tuesday, 12/20, my toddler daughter was sick and wasn't allowed to go

back to daycare for 24 hours. So I thought I would be SUPER DAD and

occasionally peek at the market to put in one successful trade after another while keeping my daughter entertained and comforted, resulting in a

win-win for everyone! WRONG!

Tuesday turned into a very bad day and I lost -13 ES points after being down as much as -19. As my mental

frame of mind became more and more agitated and irate with both being

wrong with my trades, along with trying to deal with a daughter that

wasn't really that sick and wanted all of my attention, it was a bad

lose-lose combination for everyone.

You name the rule, and I broke it. And it was all my fault for

thinking I could pull this off. What was I thinking? I essentially lost all of my profits from the past 2 weeks, all in a single day.

Wednesday 12/21: +8 (morning session only)

Whereas today, I started the day with a +3.25 profit

from the overnight session, which gave me a nice little cushion

(especially mentally) to start the day. After my first trade of the day

was a loser, my next trade went as much as +8 in profits, but closed it

out with only +2.50. A bit deflating.

So what did my mind tell me to do after a negative experience? I took a revenge trade only minutes

after that prior trade, ended up being a full stop, and decided to settle down and

regroup. I kept looking for good setups and ended up being up +8 in the

morning.

I left and went out to lunch, and decided not to trade again so that I

can be guaranteed of a +8 day as well as prepare for my in-laws arriving tonight. And as expected, I had at least +6 or more in

missed trade opportunities.

The in-laws effect

Since my in-laws are coming into town tonight, I don't have time to do

my usual trade review to calculate my execution score and opportunity costs, so that will have to wait.

I will not likely

be trading tomorrow, especially since I'm sure my stress levels will be

way too high with the in-laws roaming around. Just imagine the effect

that the spillover from the additional in-law related stress would cause

on my trading performance!

Maybe I'm finally learning to be a little smarter about when NOT to trade.

Wednesday, December 21, 2011

Being mentally ready to trade...and when NOT to trade

Labels:

psychology,

recap

Monday, December 19, 2011

Deja vu?

Monday, December 19

Total gross profits: -($175.00) -3.50 ES points

Total trades: 10 [0 scratch]

Accuracy: 40.0%

Execution score: 65.5%

Opportunity cost: $ -5.75

(yes, my rogue trades actually benefited me)

Today felt like Friday, right when the markets started to tank in the late morning before the lunch hour. And once again, I started to buy at various levels on the way down. But this time, I was better prepared. I kept telling myself how this feels just like Friday's action, and used a little more caution.

But in the end, I still ended up having 5 full stop losses out of 10 total trades (1 of them was a rogue setup). The markets the past few days seem to have been very tricky, and so this must be the whole "thin volume holiday trading" condition everyone talks about.

Bad execution score / favorable opportunity cost?

My execution score was 65.5% (3.5 non-compliant trades out of 10), so I didn't do very well from that perspective. But what's more surprising is that the related opportunity cost was a favorable -287.50 or -5.75 points. This means that had I not taken the rogue trades, I would have had a bigger loss today.

But to be more clear, it was a single rogue trade I took at the end of the day that ended up making +5.75. If you were to add up the opportunity costs from the other 2.5 trades, they washed out. So I'm not sure how to take this. On the one hand, I had a smaller loss than I should have. But on the other, isn't this one step closer towards consistently undisciplined behavior?

And what if?

And this brings up an interesting question. What if my opportunity costs start to become consistently negative? Essentially, this means that my rogue trades or "mistakes" are actually net positive for the bottom line.

More tracking to do

I've struggled with avoiding trades that I know have a decent chance of working, since it's not part of my trading plan. But this "opportunity cost" metric might be another way of tracking to see if there are certain setups that I "mistakenly" take, but have a good probability of working well over time.

Why fight it?

Because if the setups that I struggle with avoiding are truly valid, why fight something that screams at you from within your soul and works in the long run? If that's the case, then I'll modify my trading plan so that I can take the trades and be at peace with myself.

Total gross profits: -($175.00) -3.50 ES points

Total trades: 10 [0 scratch]

Accuracy: 40.0%

Execution score: 65.5%

Opportunity cost: $ -5.75

(yes, my rogue trades actually benefited me)

Today felt like Friday, right when the markets started to tank in the late morning before the lunch hour. And once again, I started to buy at various levels on the way down. But this time, I was better prepared. I kept telling myself how this feels just like Friday's action, and used a little more caution.

But in the end, I still ended up having 5 full stop losses out of 10 total trades (1 of them was a rogue setup). The markets the past few days seem to have been very tricky, and so this must be the whole "thin volume holiday trading" condition everyone talks about.

Bad execution score / favorable opportunity cost?

My execution score was 65.5% (3.5 non-compliant trades out of 10), so I didn't do very well from that perspective. But what's more surprising is that the related opportunity cost was a favorable -287.50 or -5.75 points. This means that had I not taken the rogue trades, I would have had a bigger loss today.

But to be more clear, it was a single rogue trade I took at the end of the day that ended up making +5.75. If you were to add up the opportunity costs from the other 2.5 trades, they washed out. So I'm not sure how to take this. On the one hand, I had a smaller loss than I should have. But on the other, isn't this one step closer towards consistently undisciplined behavior?

And what if?

And this brings up an interesting question. What if my opportunity costs start to become consistently negative? Essentially, this means that my rogue trades or "mistakes" are actually net positive for the bottom line.

More tracking to do

I've struggled with avoiding trades that I know have a decent chance of working, since it's not part of my trading plan. But this "opportunity cost" metric might be another way of tracking to see if there are certain setups that I "mistakenly" take, but have a good probability of working well over time.

Why fight it?

Because if the setups that I struggle with avoiding are truly valid, why fight something that screams at you from within your soul and works in the long run? If that's the case, then I'll modify my trading plan so that I can take the trades and be at peace with myself.

Sunday, December 18, 2011

The jack broke while changing the tire, but I ended up OK

Friday, December 16

Friday, December 16Total gross profits: -($37.50) -0.75 ES points

Total trades: 22 [2 scratch]

Accuracy: 50.0%

Execution score: TBD

Opportunity cost: $ TBD

As I was putting the "tire" back on the car today from my ugly day yesterday (Thursday, 12/15), I thought I was making good progress. But then, the "jack" broke and the car came crashing down with a thud. Luckily, I didn't get hurt, regrouped, and ended the day about the same place as I started (excluding commissions).

SIMPLIFIED SUMMARY:

I was up +4 (I'm back!), then torn up by a nearly -12 run (I'm not!), scrambled to gain nearly +8 points in less than 2 hours, and ended the day just about breakeven (phew!). A little roller coaster ride.

All the while, Renato made a call to short the high of the day (yes, once again) in the morning, and if you scaled out and held a runner until the close, you got at least +13 or more on the final contract. He had a nice, relaxing day before the weekend. Yet another impressive winning week for him.

DIGGING MYSELF OUT OF A HOLE - REVISITED - AGAIN

This "digging out of the hole" trading reminded me of days when I was trading stocks several months ago. More often than not, I would start the day on a bad note and scramble my way back to breakeven. As noted in the prior post from a few months ago, I have a different mindset when trading from a position of having profits vs. being deep in the red with back against the wall. This is something I will continue to address, since there's something going on there.

RANDOM THOUGHTS

- Opex in December, low volume choppy semi-holiday feeling day. Does it really matter one way or another? Just trade what you see, right?

- I have a tendency to get tired and sloppy starting around lunchtime. This causes stupid mistakes.

- When the ES started to tank during lunchtime and it felt somewhat fake and lame news driven, my mindset became "get in on the action and fade the move!"

- Did I mention how I tend to make stupid mistakes around lunch?

- Am I done with my Christmas shopping yet?

- I'm trying to learn to fish in a way that fits my style, that's why it's hard for me to blindly follow Renato's (very successful) Diamond Setups alerts.

- When I follow my trading plan, everything feels simple and straightforward. It's almost mindless and businesslike to follow the process. And isn't this interesting, although it seems like I miss out on a lot -- results are generally good and stable.

- When trading rogue based on instincts, it demands much more mental focus and energy beyond just execution. Results can be much more volatile (usually to the negative side).

- When push comes to shove and I'm up against the wall, I don't get scared, and I don't give up. Historically, my scrambling has worked much more often than not.

- But what if it doesn't work? Will I stop trying, when my account is at ZERO?

- What am I scared of? We'll be having 5 people (including in-laws) staying with us for a week over the holidays. Probably will NOT be trading during that time.

- Screen time and intensive trade reviews -- no other substitute for learning how to trade. My directions to trade have finally become IKEA like.

- Supreme control over my mental chatter (i.e. "Gambler Grove") and only doing what's right -- this will be my holy grail. Biggest challenge now (and likely forever).

- Interesting thought - without a good breakfast and lunch, I lose energy and don't trade well. Need to track, but I think there's something there.

- Another interesting thought - when I exercise during the morning, I do better. Also need to track.

- I can feel it -- 2012 will be a great year.

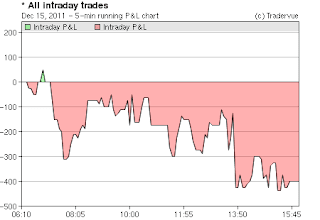

Thursday, December 15, 2011

A wheel fell off today

Thursday, December 15

Total gross profits: -($300.00) -6.00 ES points

Total trades: 30 [5 scratch]

Accuracy: 40.0%

Execution score: FAIL

Opportunity cost: $ [Didn't bother to calculate]

Over the past couple days, it was pretty clear that the wheels were starting to wobble. Well, today, one of the wheels fell off. I'm lucky I didn't end up totaling the whole car, but I did suffer some damage. Due to the number of trades, the commissions are a bigger factor and will bring the net loss closer to -9 ES points.

The problem was entirely mental:

* Lack of sleep - that's life, it happens. But I can choose not to trade.

* No patience - I felt like I needed to try and trade every turn on a tick chart. I couldn't walk away and wait for a the right setup.

* Rattled mindset - instead of being relaxed, I was way too rattled and scattered. Lost focus of my plan.

* Focus on profits, not process - mental chatter was "gotta get some profits!" vs. "must follow process"

From the very first trade, I had a mindset that I needed a winning trade. When the first couple ended up being breakeven trades, I tried to press harder, resulted in a full stop loss, resulting in the need to make it up.

I was constantly looking for setups that weren't really there or clean. Upon my trade review, I even noticed that I even became fixated on a particular pivot level that was not very relevant throughout the day (which resulted in a few bad trades).

This type of mindset carried on through the entire day and the performance figures speaks for itself. My usual stats are relatively consistent, but today, they are very much out of the normal range. When I focus on profits instead of process, it's clear that I can get into trouble.

Sure, the market was perhaps a little slower and choppier, not so unusual as we approach opex and the holidays. But I can't blame the markets, I take sole responsibility for my actions.

I will regroup, reset, and adjust my frame of mind -- learn to slow down, focus, and match the conditions of the markets. Focus on process NOT profits. Failure to do so will result the other wheels to wobble and fall off, possibly leaving me stuck in a ditch!

Total gross profits: -($300.00) -6.00 ES points

Total trades: 30 [5 scratch]

Accuracy: 40.0%

Execution score: FAIL

Opportunity cost: $ [Didn't bother to calculate]

Over the past couple days, it was pretty clear that the wheels were starting to wobble. Well, today, one of the wheels fell off. I'm lucky I didn't end up totaling the whole car, but I did suffer some damage. Due to the number of trades, the commissions are a bigger factor and will bring the net loss closer to -9 ES points.

The problem was entirely mental:

* Lack of sleep - that's life, it happens. But I can choose not to trade.

* No patience - I felt like I needed to try and trade every turn on a tick chart. I couldn't walk away and wait for a the right setup.

* Rattled mindset - instead of being relaxed, I was way too rattled and scattered. Lost focus of my plan.

* Focus on profits, not process - mental chatter was "gotta get some profits!" vs. "must follow process"

From the very first trade, I had a mindset that I needed a winning trade. When the first couple ended up being breakeven trades, I tried to press harder, resulted in a full stop loss, resulting in the need to make it up.

I was constantly looking for setups that weren't really there or clean. Upon my trade review, I even noticed that I even became fixated on a particular pivot level that was not very relevant throughout the day (which resulted in a few bad trades).

This type of mindset carried on through the entire day and the performance figures speaks for itself. My usual stats are relatively consistent, but today, they are very much out of the normal range. When I focus on profits instead of process, it's clear that I can get into trouble.

Sure, the market was perhaps a little slower and choppier, not so unusual as we approach opex and the holidays. But I can't blame the markets, I take sole responsibility for my actions.

I will regroup, reset, and adjust my frame of mind -- learn to slow down, focus, and match the conditions of the markets. Focus on process NOT profits. Failure to do so will result the other wheels to wobble and fall off, possibly leaving me stuck in a ditch!

Labels:

psychology,

recap

Wednesday, December 14, 2011

Not so perfect execution day

Wednesday, December 14

Total gross profits: $200.00 +4.00 ES points

Total trades: 19 [5 scratch]

Accuracy: 57.1%

Execution score: FAIL

Opportunity cost: $387.50 +7.75 ES points

Yesterday, the final sentence in my update was: "Now the tough part is to maintain focus and consistency to stick with the plan."

Well, that didn't last very long. Today, my execution score = FAIL.

After a morning with: (1) several trades that went +1.50 before getting stopped out at breakeven, or (2) not getting fills on trades (that ended up working), or (3) gritting my teeth while avoiding great non-strategy setups (that ended up working), I thought I was taking everything in stride.

Here's how it started

There was one trade I took after lunch that I knew immediately prior to pulling the trigger, was rogue. Terrible feeling. I exited a little early with a reduced loss, but the damage was done. A crack was formed in the foundation.

Later, after I entered a trade with a short position that should have been a long, I immediately exited with a -1 point loss, but the crack in the foundation grew bigger. The erroneous short would have worked just fine, had I not caught the error, but instead, I got a full stop loss with the "correct" long trade.

Revenge!

This flustered me, and my mind went into partial REVENGE mode to try and quickly correct what went wrong. I had to get it back, and more! From this point forward, my sense of control was partially gone. But upon review, the biggest loss of control was not in stock selection, but in my trade management. Upon entry of a trade, I threw my +2 target down the chasm which used to be just a crack, and started seeing every trade as a potential runner for +10 points. Shame on me.

Don't I get it? If trading just 1 contract, stick with a +2 target!

In my trading log, there were 3 trades during the forgettable afternoon that I entered properly per my trading plan, but I decided NOT to take the +2 profit target (instead, I moved my stop loss to breakeven and let it go for the big runner). The opportunity cost for those trades was +$300.00, or +6.00 ES points, out of a possible $387.50.

I'm sounding like a broken record this week, but today should have been a 10+ ES points type of day.

On the bright side

At the end of the day, it felt like I was just involved in a day where I had lost -20 points. But due to the combination of the Diamond Setups methodology along with the experience I've been gaining over the past 9 months, I feel as though I've hit a milestone of sorts - if I can continue to minimize my "bad" days to small losses or at breakeven, this will truly be a significant accomplishment.

I also felt that even with these tricky markets, I'm starting to gain a better feel for the constantly shifting conditions of the markets, as well as reading the quality of the setups as they take place. Although I believe I'll always continue to make adjustments to my trading plan, I feel as though I'm finally getting in the ballpark with a trading plan that works for me and my style.

And lastly, similar to how I ended my entry yesterday, I will need to prove to myself that I can maintain my focus and consistency so that I can earn the right to trade bigger and expand my trading plan. Focus on the present...do what's right. And soon, those 10+ ES point days will become a reality. I really can sense it.

Total gross profits: $200.00 +4.00 ES points

Total trades: 19 [5 scratch]

Accuracy: 57.1%

Execution score: FAIL

Opportunity cost: $387.50 +7.75 ES points

Yesterday, the final sentence in my update was: "Now the tough part is to maintain focus and consistency to stick with the plan."

Well, that didn't last very long. Today, my execution score = FAIL.

After a morning with: (1) several trades that went +1.50 before getting stopped out at breakeven, or (2) not getting fills on trades (that ended up working), or (3) gritting my teeth while avoiding great non-strategy setups (that ended up working), I thought I was taking everything in stride.

Here's how it started

There was one trade I took after lunch that I knew immediately prior to pulling the trigger, was rogue. Terrible feeling. I exited a little early with a reduced loss, but the damage was done. A crack was formed in the foundation.

Later, after I entered a trade with a short position that should have been a long, I immediately exited with a -1 point loss, but the crack in the foundation grew bigger. The erroneous short would have worked just fine, had I not caught the error, but instead, I got a full stop loss with the "correct" long trade.

Revenge!

This flustered me, and my mind went into partial REVENGE mode to try and quickly correct what went wrong. I had to get it back, and more! From this point forward, my sense of control was partially gone. But upon review, the biggest loss of control was not in stock selection, but in my trade management. Upon entry of a trade, I threw my +2 target down the chasm which used to be just a crack, and started seeing every trade as a potential runner for +10 points. Shame on me.

Don't I get it? If trading just 1 contract, stick with a +2 target!

In my trading log, there were 3 trades during the forgettable afternoon that I entered properly per my trading plan, but I decided NOT to take the +2 profit target (instead, I moved my stop loss to breakeven and let it go for the big runner). The opportunity cost for those trades was +$300.00, or +6.00 ES points, out of a possible $387.50.

I'm sounding like a broken record this week, but today should have been a 10+ ES points type of day.

On the bright side

At the end of the day, it felt like I was just involved in a day where I had lost -20 points. But due to the combination of the Diamond Setups methodology along with the experience I've been gaining over the past 9 months, I feel as though I've hit a milestone of sorts - if I can continue to minimize my "bad" days to small losses or at breakeven, this will truly be a significant accomplishment.

I also felt that even with these tricky markets, I'm starting to gain a better feel for the constantly shifting conditions of the markets, as well as reading the quality of the setups as they take place. Although I believe I'll always continue to make adjustments to my trading plan, I feel as though I'm finally getting in the ballpark with a trading plan that works for me and my style.

And lastly, similar to how I ended my entry yesterday, I will need to prove to myself that I can maintain my focus and consistency so that I can earn the right to trade bigger and expand my trading plan. Focus on the present...do what's right. And soon, those 10+ ES point days will become a reality. I really can sense it.

Labels:

diamond setups,

recap,

tradervue

Tuesday, December 13, 2011

Perfect execution day

Tuesday, December 13

Tuesday, December 13Total gross profits: $225.00 +4.50 ES points

Total trades: 3 [0 scratch]

Accuracy: 100.0%

Execution score: 100%

Opportunity cost: $0 +0 ES points

The FOMC minutes news release seemed to stall the markets after the lunch hour began, and 30-45 minutes after the release is when the markets really started to move. All my trades were in the morning.

Perfect Execution

I only had 3 trades today, but achieved a 100% execution score of those trade. I couldn't have done any better to follow my trading plan, so this is a nice successful day based on that metric.

But...

However, there were several trades I missed either because they didn't quite fit my trading plan; I wasn't around; or I simply froze.

For example, Renato's final alert of the day at 15:33 was to buy as low as 1213.00. And the low of the day ended up being 1212.50 about 3 minutes later. At the time of the call, it felt like the ES was a runaway freight train headed to 1000.00.

I froze

I froze, and couldn't pull the trigger. Not usually a problem, so it's a mental challenge I need to work on. Time and time again, Renato uses the Diamond Setups method to give timely and gutsy alerts that end up catching big turning points. It's very impressive to see. So why is it so hard to just execute the alerts?

Coulda shoulda woulda - missed trades

I'm made it a point not to include missed trades in my opportunity costs or execution score, because in the big scheme of things, I will always miss trades. But today was a day that I can't help but think of them.

I guestimate at least +4 to +6 points that I left on the table. Maybe it was the higher level of conviction I had with these missed that made me dwell about them more?

On track / plans for next month

But from the big picture perspective, I believe I'm slowly but surely headed in the right direction, especially based on my goal of maintaining discipline to strictly follow my trading plan.

If I close out this month and score well to maintain my discipline to follow my "highly focused" (i.e. restrictive) trading plan, then I will consider loosing up my plan ever so slightly to include other setups starting in January.

Now the tough part is to maintain focus and consistency to stick with the plan.

Labels:

recap

Monday, December 12, 2011

Was this a difficult trading day?

Monday, December 12

Monday, December 12Total gross profits: $87.50 +1.75 ES points

Total trades: 12 [4 scratch]

Accuracy: 62.5%

Execution score: 75%

Opportunity cost: $350 +7.00 ES points

New metric:

Execution Score. % of trades that followed the plan based on: 1) trade selection and 2) trade management

NOTES:

I'm sure there were other folks out there that just shorted this market early and rode the wave down. But for someone who is generally trying to scalp +2.00 ES points, today seemed to be a lot more difficult to find good setups that worked. Somewhat surprising, especially for what appears at first glance to be a nice 18 point down trending day.

When I did get into a trade, there were at least 5 of them that either went +1.50 or +1.75 and then stopped me out at break even/couple ticks profit. Or, I made sloppy mistakes such as bringing down my trailing stop too soon, thereby stopping me out before my +2.00 profit target was hit.

When I calculated my opportunity cost today, I realized that there were 3 trades that accounted for total of +7.00 ES points, so I was quite surprised by this. 2 of those trades were scratched or had a small loss due to bringing in stops too early (or I panicked), and those could have had +2.00 profits each. And the other trade was one where I entered the wrong order, got filled, realized the error, but decided to let it ride to a full stop loss.

It's interesting how these seemingly one-off trades can really make or break your day. I'm just thankful that my day didn't end deep in the red. Because these are the types of days that can test ones patience, and eventually make you take careless actions that you later regret. In the past, I would have been chopped up by this market. But now, I'm better prepared to mentally handle these types of days, although I'm far from perfect and still have a lot of room for improvement.

One big factor that helps me deal with these challenging days is by being in contact with the community of traders and with Renato in the Diamond Setups chatroom. This has been huge. In the past, it felt as though I was trading in isolation. But now, if feels as though we're all working together towards the same goal.

Tomorrow's a new day, and I'll be ready, a little bit wiser.

Labels:

recap

Saturday, December 10, 2011

Rogue trades appeared, but luck was on my side

Friday, December 9

Friday, December 9Total gross profits: $262.50 +5.25 ES points

Total trades: 15 [2 scratch]

Accuracy: 69.2%

The morning started strong and had I just

stuck to my +2 profit target mentality, I could have had 5 winners with +2 in a

row, before getting my a full stop loss.

But I believe there was a bit of greed that came into the picture, since the trades I tried to let run were Diamond Setups chatroom alerts (they often run for much more than +2), and so with lack of sleep the night prior, I was not as mentally strong to stay disciplined to my plan.

Of the 15 trades I took today...

1 was an error I didn't expect (confirmation was accidentally off on my DOM)

1 was a decent setup, but in hindsight, not according to my plan

2 were flat out rogue trades. These were most disturbing to me.

Without those erroneous trades, I would have had about 11 trades, which seems like a nice sweet spot for my personality and style.

I broke down

I was doing so well this week with my discipline of sticking to the plan, but after a full stop loss during the lunch hour, I entered a couple rogue trades, fully aware that it was not a part of my plan. This was disturbing. Old revenge habits came back. But I became aware of it, and stopped before it got out of hand.

Lack of sleep combined with end of week fatigue is not a good combination. Perhaps I'll need to consider ending the trading early on Friday. And if tired from a lack of sleep, I will need to find a way to walk away and avoid trading.

My opportunity cost

+6.50. If I would have simply exited at a profit target of +2, I would have made +6.50 more to my +5.25 day.

So, +11.75 is what I could have made today had I been more disciplined in simply exiting at my primary target of +2.

Lucky

What's very surprising is that my rogue or trades taken in error were actually either breakeven, or even had an opportunity for decent profits. This is unusual, since in my experience, they usually hurt you a lot. I will credit luck.

But overall, this wasn't a bad way to end my first week back trading live. I'll take it.

But I believe there was a bit of greed that came into the picture, since the trades I tried to let run were Diamond Setups chatroom alerts (they often run for much more than +2), and so with lack of sleep the night prior, I was not as mentally strong to stay disciplined to my plan.

Of the 15 trades I took today...

1 was an error I didn't expect (confirmation was accidentally off on my DOM)

1 was a decent setup, but in hindsight, not according to my plan

2 were flat out rogue trades. These were most disturbing to me.

Without those erroneous trades, I would have had about 11 trades, which seems like a nice sweet spot for my personality and style.

I broke down

I was doing so well this week with my discipline of sticking to the plan, but after a full stop loss during the lunch hour, I entered a couple rogue trades, fully aware that it was not a part of my plan. This was disturbing. Old revenge habits came back. But I became aware of it, and stopped before it got out of hand.

Lack of sleep combined with end of week fatigue is not a good combination. Perhaps I'll need to consider ending the trading early on Friday. And if tired from a lack of sleep, I will need to find a way to walk away and avoid trading.

My opportunity cost

+6.50. If I would have simply exited at a profit target of +2, I would have made +6.50 more to my +5.25 day.

So, +11.75 is what I could have made today had I been more disciplined in simply exiting at my primary target of +2.

Lucky

What's very surprising is that my rogue or trades taken in error were actually either breakeven, or even had an opportunity for decent profits. This is unusual, since in my experience, they usually hurt you a lot. I will credit luck.

But overall, this wasn't a bad way to end my first week back trading live. I'll take it.

Labels:

recap

Thursday, December 8, 2011

Deceptive performance - I pulled 'da trigger but...

Thursday, December 8

Thursday, December 8Total gross profits: $262.50 +5.25 ES points

Total trades: 8 [1 scratch]

Accuracy: 65.0%

NOTES:

With 10 trades today (I pulled the trigger and they were all within the trading plan) and many more profitable trades that I passed up (continued sign of discipline) or simply missed (can't get them all, I'm human), one would think that I would have cleaned house and banked more coin than usual. But the "average looking" bottom line results today is a little deceptive.

During the trading session, I wasn't paying as much attention to the "what could have been" with the trades that didn't quite work out -- just trying to focus on taking good setups and solid trade execution. So when I reviewed my trades today, I discovered that the element of "luck" was not on my side, much more than I thought during the day.

There were several trades that hit +1.75 and didn't get quite at or beyond +2.00 for a fill on my profit limit order. So I got stopped out at breakeven or a couple ticks profit. In total, when you add up those "unlucky" trades as well as the other actual trades taken but with errors, my opportunity cost (i.e. what could have been) would have added +7.75 points to my bottom line.

Which means, if luck was on my side, I could have had a +13.00 day.

From the execution perspective, there weren't too many errors, although there were a couple. I didn't scratch the first trade as I should have. But what was much worse was my second error -- my personal bias kept me from staying with Renato's alert to buy. I was short biased entering the trade, and when I was almost stopped out, I exited at +2 ticks instead of sticking with the trade. And of course, the trade eventually made at +2.00 points.

Looking back on today, I like this new mindset of focusing only on good trade selection and executing properly...according to the plan. Forget about everything else. Day by day, with the foundation of the Diamond Setups methodology on my side, I'm realizing that if luck is NOT on my side, I won't get hurt too bad. But if luck is on my side, the potential for having a great day is really possible...a lot more often than I would have ever imagined.

Labels:

recap

Wednesday, December 7, 2011

Did I forget how to pull 'da trigger?

Wednesday, December7

Wednesday, December7Total gross profits: $237.50 +4.75 ES points

Total trades: 3 [0 scratch]

Accuracy: 100.0%

NOTES: After what I thought were the less than perfect conditions over the past couple days, we end up with a day like today where the ES seems to be working the way it's supposed to.

You know those days, where you say, "It'll go up/down from here", and it does, and again, and again... There seemed to be great setups all over the place in the morning, as well as the afternoon once the usual lunchtime doldrums passed. I could have had ten or more trades today, and perhaps booked +15 ES points or likely much more. It was that good of a day.

But...only 3 trades today

But today, I only had 3 trades and all of them were before lunch. Whereas Renato and his Diamond Setups alerts had at least 10+ points and few more trades. I missed some of the DS alerts simply by not being here, or having an order not get filled. But there was one DS alert late in the afternoon that I deliberately passed (bad decision, it made money, and rule #1 is to take all of Renato's trades).

The one that got away

And another near perfect setup I missed (I returned to my computer about 1-2 minutes too late) was late in the final hour that ended up riding the news driven move sharply higher.

|

| ESZ1 30m - The one that got away |

Perhaps the pendulum has swung the other way a little too far, and now I'm being too critical of my setups? Did I forget how to pull the trigger? I thought about that, and for now, I believe everything is OK. After trading in the style of the Wild Wild West for the past month or so, any type of rigid discipline will feel quite restrictive to me. This is only my 3rd day on "the plan", which is restrictive and focused by design, so I consider all of this a part of my adjustment period.

Bottom line - Success!

With that in mind, I was very successful today. No rogue trades, and many setups were rejected (and nearly all were profitable). I was very disciplined.

Next time...

In the future, when I see this type of day come up again, I'll be ready. Interestingly, I don't feel any regret or disappointment with today, since I know this isn't the last time we'll ever see a market like this again. So when days that are "in tune" with your trading method come up and you're in the zone, you really have to capitalize on it and go for the jugular. As a trader, I believe there are absolutely no excuses not to pounce hard when great opportunities presents itself.

Labels:

diamond setups,

recap

Tuesday, December 6, 2011

OK execution but mistakes cost me a lot

Tuesday, December 6

Tuesday, December 6Total gross profits: $75.00

Total trades: 10 [2 scratch]

Accuracy: 50.0%

Contracts per trade: 1

NOTES:

After an uneventful day yesterday, I was pretty sure today would provide better opportunities, but it was only a little better. Most of the regular trading day was in a choppy narrow range, except for a sharp 9 point news driven move, both up and down, during the final 1 1/2 hours.

EXECUTION REVIEW:

- Of the 10 trades taken, it was clear that 2 of the trades were not traded according to plan.

- Rogue trade #1: Took place when I exited a short trade generated by Renato's DS alert trade while it was still active, only to take a long setup that had a full -2.50 stop. Renato's trade went more than +5, so I could have gotten at least a +2. OPPORTUNITY COST = 2.50 + 2.00 = 4.50 points.

- Rogue trade #2: Was when I had gotten stopped out of a trade due to yet another Euro bailout news, and then tried to short against the news driven move before even waiting for the 30min bar to close. This was partially revenge driven and resulted in a -2.25 trade.

- I missed Renato's final call of the day and missed a fill by just a few ticks. Based on how I usually execute his alerts, it would have gotten hit, but for whatever reason, I entered a more conservative entry level. That trade went as much as +9, but I count this as a +2 "could have" trade.

|

| Screenshot from my Tradervue.com journal - it's great, it's FREE! |

SUMMARY:

6.75 points -- that's conservatively how much the rogue trades cost

me today. 4.50 + 2.25 = 6.75. Wow. I'm not even including the +2 trade based on Renato's final alert that I missed. Shows how a couple of

mistakes resulting in losses and lost opportunity can really impact the bottom line.

Therefore, a +8.25 day, that's what today could have been vs. a +1.50 day, had I

been more careful and executed well against my plan. Perhaps I need to reconsider

what I wrote in the first sentence above! CHART:

I only took advantage of some of the key areas today (highlighted in dark green) as appropriate with my current trading plan. This is NOT a part of the Diamond Setups. In the future, I will utilize these charts to better supplement the Diamond Setups trades.

I believe there is great synergy and opportunity, but for now, I need to keep things as simple as possible and just execute well against my plan.

|

| ES 5 min 12/6/2011 |

Labels:

diamond setups,

recap,

tradervue

Monday, December 5, 2011

Back trading live and it's a scratch day

| |

| P&L shows loss on the 5min bar after I had already exited the position. |

Total gross profits: $0.00

Total trades: 4 [2 scratch]

Accuracy: 50.0%

Contracts per trade: 1

NOTES: First day trading live since last month, and the gross P&L of $0 pretty much explains how most of my trading day went today. Only 4 trades today, which is also unusual.

However, there were definitely some moments of action that moved the markets. A planned ISM news release at 10:00 AM moved things a tad, but it then chopped sideways in a 7.50 point range for several hours. There was also unexpected news around 14:00 regarding the pending downgrades of 6 countries by S&P, which really woke the market up.

But for whatever reasons, I was not able to capitalize on the volatility. The chatroom was also pretty much close around break even or up a small amount today...that is, up until Renato made a final call to short that triggered around 15:00, made at least +7 to +9 ES points. Since I'm only trading one contract and can't scale out, I had at least +1.50, got stopped out at breakeven, and then saw the market really tank. Can't get 'em all!

Execution Review:

- Of the 4 trades I took, the setup selection quality was good to excellent, and the trade management execution (moving stop orders) went well. I'm satisfied with the results of the trades taken.

- Even though there were a couple instances where I was stopped out at breakeven even after the trade was +1.50 to +1.75 profitable, I followed my rules. I feel absolutely no remorse or disappointment that I did not close out with a profit vs. breakeven, because over time, learning to hold on through the shake outs will be more profitable (for example, when I start trading multiple contracts to scale out).

- There were a few other good setups that I missed, but missing trades will be relatively normal and acceptable. What's absolutely critical is that I don't offset my missed trades by taking low quality setups.

- Speaking of which, I did NOT overtrade, which was a BIG WIN today, especially since choppy periods have historically lured me in and chopped me up.

- During the morning and through the lunch hour, I was bitching and complaining how everything was choppy, range is too narrow, how most setups were not "clean", etc. My plan is to wait for the close of the 30min bar to help determine the next course of action, and that was vital in keeping me out of overtrading trouble. One way I helped accomplish this was to leave the computer and return by the close of the 30min bar.

Labels:

execution review,

recap

Friday, December 2, 2011

Final days of SIM trading

After accidentally trading live last month, then saying "what the heck" and continuing to trading live, then suffering some ugly meltdown losses, then going back to SIM with tail between legs, then doing a lot of various experimentation with trading styles, then digging deep into the psychology of trading, then understanding my strengths and what works for me, then finally settling down and writing down a trading plan I'm totally bought into...it's time I start trading live next week.

This time, I'm ready.

* * * * *

The final days of SIM

Thursday, December 1

Thursday, December 1

Total gross profits: $87.50 +1.75 ES points

Total trades: 4 [1 scratch]

Accuracy: 66.7%

Contracts per trade: 1

NOTES: Wasn't able to start watching the markets until 1:00 PM, and I ended up taking 4 trades, one of which was a loser and 1 scratch that I closed out at b/e. However, if I had just stuck to the plan, the scratch would have turned into a full win. Opportunity cost was $140.

Friday, December 2

Friday, December 2

Total gross profits: $400.00 +8.00 ES points

Total trades: 14 [0 scratch]

Accuracy: 71.4%

Contracts per trade: 1

NOTES: Late start, did not start trading until 10:15 AM, well after the unemployment report was released. Ended up having a lot more trades than expected (and desired), since I became fixated on the 1250 level during the lunch hour and had 6 trades during that time. Although the bottom line was fine, I was less than satisfied with the quality of trade selection during that lunch hour -- net result was -$100 gross. There were also 3 trades that went nearly +2 (missed by a tick or two), and closed just above breakeven (just wasn't lucky).

* * * * *

An interesting update is how well the 5 minute chart I update during the day is integrating well with the Diamond Setups system. In the chart below, the dark green highlighted areas represents good locations for trade entries.

So when a DS setup also lines up in those particular areas, I believe it increases the confidence level for that particular trade. Therefore, this may help to increase the overall accuracy and profitability of my trading, although further tracking and research is necessary to make sure I'm not fooling myself.

This time, I'm ready.

* * * * *

The final days of SIM

Thursday, December 1

Thursday, December 1Total gross profits: $87.50 +1.75 ES points

Total trades: 4 [1 scratch]

Accuracy: 66.7%

Contracts per trade: 1

NOTES: Wasn't able to start watching the markets until 1:00 PM, and I ended up taking 4 trades, one of which was a loser and 1 scratch that I closed out at b/e. However, if I had just stuck to the plan, the scratch would have turned into a full win. Opportunity cost was $140.

Friday, December 2

Friday, December 2Total gross profits: $400.00 +8.00 ES points

Total trades: 14 [0 scratch]

Accuracy: 71.4%

Contracts per trade: 1

NOTES: Late start, did not start trading until 10:15 AM, well after the unemployment report was released. Ended up having a lot more trades than expected (and desired), since I became fixated on the 1250 level during the lunch hour and had 6 trades during that time. Although the bottom line was fine, I was less than satisfied with the quality of trade selection during that lunch hour -- net result was -$100 gross. There were also 3 trades that went nearly +2 (missed by a tick or two), and closed just above breakeven (just wasn't lucky).

* * * * *

An interesting update is how well the 5 minute chart I update during the day is integrating well with the Diamond Setups system. In the chart below, the dark green highlighted areas represents good locations for trade entries.

So when a DS setup also lines up in those particular areas, I believe it increases the confidence level for that particular trade. Therefore, this may help to increase the overall accuracy and profitability of my trading, although further tracking and research is necessary to make sure I'm not fooling myself.

Labels:

recap,

reflections

Wednesday, November 30, 2011

Rules of Engagement - Trading Plan for week of 12/5/2011

No trades today

I was out longer than usual this morning and when I returned, that big spike up due to the "collusion" of the world Central Banks injecting Cortisone threw my charts (and me) for a loop. Therefore, I generally stood back and just watched.

In addition, the sound of construction workers banging away in the basement combined with not enough sleep last night also contributed to my lack of action (to play it safe, even on SIM). However, I did try an entry, but it didn't fill. And I also missed one of Renato's alerts that ended up being profitable.

Although I didn't trade, Renato gave several alerts that I believe gained at least a few ES points in total. The summary he gave of his net performance for the month of November was simply amazing and inspiring. He has made me into a believer that taking small and steady bites every day can add up to substantial returns over a month.

So I worked on my trading plan

The lack of trading gave me time to focus on my trading plan for next week when I start trading live once again. As I wrote in my last trading plan back in August, the primary goal will be to test my ability to follow my trading rules -- in other words, maintain discipline to focus on the process.

I have deliberately simplified the setups in the trading plan below in order to respect the proprietary nature of the DS system. But for those who are familiar with DS, I'm sure you'll see that these rules are very straightforward and should be easily to execute (at least in theory).

How I will judge myself

At the end of next week, I will not rate myself on whether I made a profit or not, but how well I executed according to the plan. I know based on my trading schedule, I will most certainly miss many good opportunities during the pre-NY open. However, of those trades that I do take, I will score them based on how well they met the criteria as well as how well I executed according to the plan.

* * * * *

Trading plan for week of December 5, 2011

[Not locked down yet, so this is still subject to revision]

PREREQUISITES

Charts:

30 minute and 377 tick charts based on DS levels, as well as my 5 min chart

Indicators:

RSI, moving averages, vwap, pivot levels

SETUPS

The following setups are in scope:

(1) Renato's DS Alerts

[Not sure if I'm going to leave this in here or not for next week]

Limit order will be placed at +2.00 points (8 ticks). This order will be sent automatically as part of a bracket order at the time of entry.

Exception: In an instance where the setup takes place at a known critical support or resistance level, once the stop is raised to +2 ticks, I will have the discretion to let the trade ride for a greater profit. However, this should only account for < 10% of total trades.

TRADE RISK MANAGEMENT

Risk per trade not to exceed 2% of portfolio

Start by trading 1 contract (therefore, risk per trade will be < 1% of portfolio)

General rule - allocate $8k-$10k per contract

STOP MANAGEMENT

The stop will be placed -2.25 from entry price, unless there is clear and compelling reason to adjust by no more than 2 ticks.

The stop loss will remain at the original location unless:

(1) The trade is +1.50 (+6 ticks), then stop will be raised to entry price/breakeven (0 ticks)

(2) The trade is +1.75 (+7 ticks), then stop will be raised to +0.50 (+2 ticks)

ACCOUNT RISK MANAGEMENT

Max daily account loss = 5% of portfolio

Max intraday drawdown = If daily profit > $500, drawdown will be kept < 30% of max profits (i.e. highwater mark)

GENERAL REMINDERS

I was out longer than usual this morning and when I returned, that big spike up due to the "collusion" of the world Central Banks injecting Cortisone threw my charts (and me) for a loop. Therefore, I generally stood back and just watched.

In addition, the sound of construction workers banging away in the basement combined with not enough sleep last night also contributed to my lack of action (to play it safe, even on SIM). However, I did try an entry, but it didn't fill. And I also missed one of Renato's alerts that ended up being profitable.

Although I didn't trade, Renato gave several alerts that I believe gained at least a few ES points in total. The summary he gave of his net performance for the month of November was simply amazing and inspiring. He has made me into a believer that taking small and steady bites every day can add up to substantial returns over a month.

So I worked on my trading plan

The lack of trading gave me time to focus on my trading plan for next week when I start trading live once again. As I wrote in my last trading plan back in August, the primary goal will be to test my ability to follow my trading rules -- in other words, maintain discipline to focus on the process.

I have deliberately simplified the setups in the trading plan below in order to respect the proprietary nature of the DS system. But for those who are familiar with DS, I'm sure you'll see that these rules are very straightforward and should be easily to execute (at least in theory).

How I will judge myself

At the end of next week, I will not rate myself on whether I made a profit or not, but how well I executed according to the plan. I know based on my trading schedule, I will most certainly miss many good opportunities during the pre-NY open. However, of those trades that I do take, I will score them based on how well they met the criteria as well as how well I executed according to the plan.

* * * * *

Trading plan for week of December 5, 2011

[Not locked down yet, so this is still subject to revision]

PREREQUISITES

Charts:

30 minute and 377 tick charts based on DS levels, as well as my 5 min chart

Indicators:

RSI, moving averages, vwap, pivot levels

SETUPS

The following setups are in scope:

(1) Renato's DS Alerts

- They work -- just take them!

- If applicable, refine entry point with 377t chart

- If there are conflicts, Renato's trade overrides all other setups

- Wait for close on 30m bar, with entry on following bar

- Ideally, trades should not be taken between 11:30AM and 1:30 PM

- Similar to Reverse DS4 setup, except this can apply to any DS level

- Ideally, take this in the direction of the intraday trend

[Not sure if I'm going to leave this in here or not for next week]

- If DS4 is involved, wait for the farther level (and realize that many profitable entries will be missed!)

- These FT setups should account for < 20% of total setups

- Since FT may be riskier, these setups must have one of the following, or else pass!

(a) 377t DS4 with RSI, or

(b) Confluence with additional non-DS level such as trendline/vwap/pivot level

Limit order will be placed at +2.00 points (8 ticks). This order will be sent automatically as part of a bracket order at the time of entry.

Exception: In an instance where the setup takes place at a known critical support or resistance level, once the stop is raised to +2 ticks, I will have the discretion to let the trade ride for a greater profit. However, this should only account for < 10% of total trades.

TRADE RISK MANAGEMENT

Risk per trade not to exceed 2% of portfolio

Start by trading 1 contract (therefore, risk per trade will be < 1% of portfolio)

General rule - allocate $8k-$10k per contract

STOP MANAGEMENT

The stop will be placed -2.25 from entry price, unless there is clear and compelling reason to adjust by no more than 2 ticks.

The stop loss will remain at the original location unless:

(1) The trade is +1.50 (+6 ticks), then stop will be raised to entry price/breakeven (0 ticks)

(2) The trade is +1.75 (+7 ticks), then stop will be raised to +0.50 (+2 ticks)

ACCOUNT RISK MANAGEMENT

Max daily account loss = 5% of portfolio

Max intraday drawdown = If daily profit > $500, drawdown will be kept < 30% of max profits (i.e. highwater mark)

GENERAL REMINDERS

- Find ANY REASON to pass up a trade -- I don't have to trade.

- However, if the setup is valid, pull the trigger!

- Don't fight the trend, save your mental and emotional capital.

- Remain in the "Now Moment" - Follow the plan and just let go -- let the trade win or lose. Zen out, man.

Labels:

diamond setups,

trading plan

Tuesday, November 29, 2011

My swing trade finaly got stopped out, so now what?

It eventually had to end. My short ES swing trade from last week was stopped out, and although I had my stop loss set at +.25 (so that I can say I never let that +50 point winner turn into a loser, ha ha!), I actually got serious slippage even though it was a SIM trade (surprise, not!). It was 1 full point slippage...IN MY FAVOR! Well how about that. Ended up closing that swing trade with +1.25.

For kicks, here's the daily P&L of that single contract ES swing trade short @ 1198.00 from 9/22:

Tuesday, November 29

Tuesday, November 29

Total gross profits: $287.50 +5.75 ES points

Total trades: 7 [3 scratch]

Accuracy: 100.0%

Contracts per trade: 1

For kicks, here's the daily P&L of that single contract ES swing trade short @ 1198.00 from 9/22:

When will I trade live again?

I'm starting to think that I should start trading live again in December, for maybe a couple weeks or so before the Christmas holidays takes over. Starting in December gives me a nice clean starting point, and I'll do my best to end the year on a good note.

The rest of this week will likely be difficult for me to trade during the peak morning hours, so I might end up waiting until Monday. However, this will give me time to start writing down my trading plan as well as my goals.

For whatever reason, it has only been in the past few days where I can truly "feel" and be comfortable with what my trading plan and strategy should be.

Now it's time to write everything down, lock them down, focus on the process, and execute the process as flawlessly as possible. I have absolutely no doubts that if I focus on trading the plan, the profits will follow.

For whatever reason, it has only been in the past few days where I can truly "feel" and be comfortable with what my trading plan and strategy should be.

Now it's time to write everything down, lock them down, focus on the process, and execute the process as flawlessly as possible. I have absolutely no doubts that if I focus on trading the plan, the profits will follow.

* * * * *

Tuesday, November 29

Tuesday, November 29Total gross profits: $287.50 +5.75 ES points

Total trades: 7 [3 scratch]

Accuracy: 100.0%

Contracts per trade: 1

A somewhat uneventful day, but one that was profitable. If I can consistently keep up this type of performance every day for a month, it will be a very respectable month. The markets seemed to be in tune with the Diamond Setups method and levels.

It was a very steady day where most trades generally moved in my favor almost immediately. I also had a certain feel, and when the trade wasn't working any longer, I correctly exited ahead of the adverse moves for scratch. Perhaps it was due to my rested state of mind (it has been about a week since I last executed a trade).

These "boring" but yet profitable days are what I would appreciate every day!

* * * * *

Once activity that has helped me to keep focused (and out of trouble) on the overall markets has been to update a 5 minute chart with trendlines and key support/resistance levels. What's surprising is how well and how often these trendlines line up with the Diamond Setups trades.

In this example, you can see how the trendlines I drew and extended ended up working well for certain DS setups (see green shaded areas).It was a very steady day where most trades generally moved in my favor almost immediately. I also had a certain feel, and when the trade wasn't working any longer, I correctly exited ahead of the adverse moves for scratch. Perhaps it was due to my rested state of mind (it has been about a week since I last executed a trade).

These "boring" but yet profitable days are what I would appreciate every day!

* * * * *

Once activity that has helped me to keep focused (and out of trouble) on the overall markets has been to update a 5 minute chart with trendlines and key support/resistance levels. What's surprising is how well and how often these trendlines line up with the Diamond Setups trades.

Labels:

charts,

diamond setups,

recap

Monday, November 28, 2011

From +50 ES point to +2 to ???

No trades for me on Monday, November 28th. Since getting into the ES

1198 short on Tuesday 11/22, I've continued to let it ride, especially

since I've been busy with non-trading related tasks as the

holiday season starts to ramp up.

So here are some thoughts as I saw my ES swing trade go up to nearly +50 points in profits, only to then watch it gap up around 20 points against me on Sunday night, and then getting within 2 points of being stopped out at break even today (Monday).

Sure, if I had real money on the line, it would likely have been much more stressful, but either way, I believe this is a lower stress way of become more self-aware with myself.

When I am trading live again, I will likely go back to daytrading/scalping primarily for +2 ES points I might consider swingtrading once I'm trading with an initial position of at least 3 or 4 contracts.

So the question that is getting louder in my mind -- when will I start trading live again? I tell myself I'm in no rush, but there's also a side of me that wants to get back in the real game NOW. Depending on market conditions, I'm thinking maybe next week at the earliest and sometime in January at the latest.

So here are some thoughts as I saw my ES swing trade go up to nearly +50 points in profits, only to then watch it gap up around 20 points against me on Sunday night, and then getting within 2 points of being stopped out at break even today (Monday).

- If this was a live trade (not SIM) I most likely would have exited earlier, probably on Sunday night for about a +20 gain.

- Renato had a buy alert... right below the 1150 area (yes, the low of the move on Friday), so although I'm not sure I would have exited there on Friday afternoon (because weak closes are usually a bearish sign), that was potentially another option.

- I could have done better daytrading vs. this swing Assuming that I

closed this single trade at the max possible +50 points, there were

many daytrade opportunities that could have made just as much or even

more during the time I was in this one swing trade. But...

- Big but... Whether I would have captured all those daytrades and actually made that much is another topic of discussion.

- Quick to enter trades, slow to exit. That's my general nature (even as a daytrader), and the reason I've been able to hold on to this position for so long -- I'm slow to exit.

- My natural Valium? Having an active open position is somewhat like putting my trigger finger on Valium. It makes me much more selective to enter new trades, unless they are very compelling.

- Permanent swing position? So maybe I need to consider having a very small swing position as a way to counteract my need to always have something cookin'. A mini-forex position comes to mind.

- External non-trading diversions There are times

when I feel I'm too close to the markets. It's as if I'm

getting too clingy. So how will I feel when the market treats me bad someday and

I have nothing else to fall back on? Either having other

hobbies and interests or being forced onto other tasks should help

provide balance. Consequently, I believe having better balance will improve my ability to stick to a plan with discipline.

Sure, if I had real money on the line, it would likely have been much more stressful, but either way, I believe this is a lower stress way of become more self-aware with myself.

When I am trading live again, I will likely go back to daytrading/scalping primarily for +2 ES points I might consider swingtrading once I'm trading with an initial position of at least 3 or 4 contracts.

So the question that is getting louder in my mind -- when will I start trading live again? I tell myself I'm in no rush, but there's also a side of me that wants to get back in the real game NOW. Depending on market conditions, I'm thinking maybe next week at the earliest and sometime in January at the latest.

Labels:

recap,

reflections

Wednesday, November 23, 2011

A +40 ES trade - it's only SIM, but let me dream...

A brief interruption to the holiday madness...

My "fluke" ES short trade from early yesterday morning seems to be doing quite well. This turned out to be one of those < 5% of my trades that ended up running, and running, and running...

So far, it's up almost +40 points (still open, so it could change) from my 1198.00 entry price around 6:50 AM on 11/22. One trade, 1 contract, 1 1/2 days, not too bad. I checked up on this trade throughout the day via my phone today while running errands, and saw no reason why I should have exited. Too bad it's a SIM trade and not real!

Even though I'm not counting this trade as legit (it was slightly rogue based on my trading plan in effect at the time), there was something about this trade that made me take it AND continue to hold it. I could also say the same thing about countless other trades that LOST money. But at a minimum, it is a bit of a confidence booster and shows my strength of being able to hold a runner through ups and downs for the big move.

Although my primary goal in the near future will continue to be capturing +2 point scalps, this example also identifies the power of identifying a trend and sticking around for a nice ride. This is further incentive for me to get up to trading 4 contracts so that I can have more opportunities to let a kicker contract run.

Maybe there's something more to this trade than I'm giving myself credit, so as a reminder of what a big win looks like, I'll post this as a reminder of what's possible.

My "fluke" ES short trade from early yesterday morning seems to be doing quite well. This turned out to be one of those < 5% of my trades that ended up running, and running, and running...

So far, it's up almost +40 points (still open, so it could change) from my 1198.00 entry price around 6:50 AM on 11/22. One trade, 1 contract, 1 1/2 days, not too bad. I checked up on this trade throughout the day via my phone today while running errands, and saw no reason why I should have exited. Too bad it's a SIM trade and not real!

Even though I'm not counting this trade as legit (it was slightly rogue based on my trading plan in effect at the time), there was something about this trade that made me take it AND continue to hold it. I could also say the same thing about countless other trades that LOST money. But at a minimum, it is a bit of a confidence booster and shows my strength of being able to hold a runner through ups and downs for the big move.

Although my primary goal in the near future will continue to be capturing +2 point scalps, this example also identifies the power of identifying a trend and sticking around for a nice ride. This is further incentive for me to get up to trading 4 contracts so that I can have more opportunities to let a kicker contract run.

Maybe there's something more to this trade than I'm giving myself credit, so as a reminder of what a big win looks like, I'll post this as a reminder of what's possible.

Labels:

recap

Tuesday, November 22, 2011

Winding down for the holiday week

Between the construction workers finally banging away and fixing our basement due to the hurricane Irene floods (how long ago was that already??), preparing for family visiting tomorrow, as well as endless other circumstances of life that popping up, it makes focusing on trading very challenging.

Yesterday - Botched SIM again

However, I did do some trades yesterday (Monday, Nov 21), but then ran into the TradeStation SIM confirmation delays once again. This threw me off track. By nature, when I see a problem, I try and isolate it and determine the root cause or at least better understand what's going on.

So I began finding excuses to put on trades just to try and make it "break" and replicate the problem. It's OK to do in SIM, but it's not OK with a live account. Needless to say, I ended up straying far from the trading plan and it's not even worth posting the performance.

Overnight trading and the "one trade" today

Last night, I decided to give overnight trading a shot, and I ended up fighting the trend, and shot myself. And before I had to head out this morning for a doctors checkup, I shorted the ES at 1198 during the pre-market session.

The trade gained as much as +18.75 on one contract, before it hit the bottom before lunch (where Renato made a Diamond Setups call at 10:57 AM to buy at 1182-80!) and it then shot up due to the IMF news about the liquidity line.

Since I was in and out all day today, I held on and it got within 3 points of my breakeven stop. I thought it would be "tragic" if I got stopped out at breakeven, but hey, it would be a lesson learned. Luck was on my side, and the ES drifted back down. And then right around the close, more news. New stress tests for banks. It ended up closing +16 in profits, and I will hold it into the overnight session.

By the way, this trade won't count on the "official" performance report, either, regardless of whether it closes with big profits or b/e. It's more of a rogue experimental trade that I had a "hunch" about.

The bigger picture

Looking back on the past few weeks, it's clear there's a big gap between my desire to go for profit targets of +2s vs. runners that go +10s and beyond. It's not necessarily mutually exclusive, but it is much more difficult to do both when trading only 1 contract, so I'll need to work on a plan to get up to 4 contracts as soon as possible. Lots of planning and goal setting work for me to do.

Well, time has run out and more non-trading duties call, but best wishes to all for a safe and wonderful Thanksgiving holiday break!

Yesterday - Botched SIM again

However, I did do some trades yesterday (Monday, Nov 21), but then ran into the TradeStation SIM confirmation delays once again. This threw me off track. By nature, when I see a problem, I try and isolate it and determine the root cause or at least better understand what's going on.

So I began finding excuses to put on trades just to try and make it "break" and replicate the problem. It's OK to do in SIM, but it's not OK with a live account. Needless to say, I ended up straying far from the trading plan and it's not even worth posting the performance.

Overnight trading and the "one trade" today

Last night, I decided to give overnight trading a shot, and I ended up fighting the trend, and shot myself. And before I had to head out this morning for a doctors checkup, I shorted the ES at 1198 during the pre-market session.

The trade gained as much as +18.75 on one contract, before it hit the bottom before lunch (where Renato made a Diamond Setups call at 10:57 AM to buy at 1182-80!) and it then shot up due to the IMF news about the liquidity line.

Since I was in and out all day today, I held on and it got within 3 points of my breakeven stop. I thought it would be "tragic" if I got stopped out at breakeven, but hey, it would be a lesson learned. Luck was on my side, and the ES drifted back down. And then right around the close, more news. New stress tests for banks. It ended up closing +16 in profits, and I will hold it into the overnight session.

By the way, this trade won't count on the "official" performance report, either, regardless of whether it closes with big profits or b/e. It's more of a rogue experimental trade that I had a "hunch" about.

The bigger picture

Looking back on the past few weeks, it's clear there's a big gap between my desire to go for profit targets of +2s vs. runners that go +10s and beyond. It's not necessarily mutually exclusive, but it is much more difficult to do both when trading only 1 contract, so I'll need to work on a plan to get up to 4 contracts as soon as possible. Lots of planning and goal setting work for me to do.

Well, time has run out and more non-trading duties call, but best wishes to all for a safe and wonderful Thanksgiving holiday break!

Friday, November 18, 2011

End of a long week - more experimentation

It was a long week, but one that ended on a relatively good note.

Friday, November 18

Total gross profits: $587.50 +11.75 ES points

[SIM adjusted gross profits: $325.00] +6.50

Total trades: 14 [1 scratch, 7 losses]

Accuracy: 42.9%

Contracts per trade: 1

NOTES:

NOTES:

An OPEX day that ended on a fizzle. I stopped trading by 2:00 PM when it became slow. But there were enough decent swings earlier in the day that allowed certain trades to run, as well as choppy areas where the DS levels did well to capture scalp trades. Yet another experimentation day, focusing primarily on the whether to use the profit target or not.

No +2.00 profit targets on some trades

Today, I decided to lift the +2.00 profit targets for certain trades that "felt" as though they had room to run. The result? My percentage accuracy went down considerably and overall average profit per trade (expectancy) remained relatively the same as a good scalping day. But the average $'s of winning trades went up considerably. Why? I had a few trades that ran a decent amount. For example, I had one trade go +6.25 and another that went +8.00.

The primary criteria I used when allowing a trade to run was whether it was near the highs/lows of the day, and/or whether it is considered a significant area due to key trendlines. These criteria in confluence with DS levels seem to provide a better than average opportunity for a trade to run beyond a typical scalp.

In this chart to the right, it's clear to see that rationale behind some of the trades were allowed to run without a +2 profit target order.

In this chart to the right, it's clear to see that rationale behind some of the trades were allowed to run without a +2 profit target order.

So the question remains, what style works best for me?

Since starting to trade earlier this year, a certain pattern I've tracked is that I am very impatient to enter a trade, but once I'm in a trade, I'm almost too patient to stay on board.

Therefore, I usually don't have the tendency to exit a profitable trade too early, but instead, I tend to overstay my welcome. This works very well on those small percentage of trades that end up running far, but in most instances, I'll let a profitable trade stop me out with a scratch or a small loss.

I believe my ability to hold onto profitable intraday trades is a strength, and so I'll have to factor that into my overall trading strategy. I'm willing to sacrifice winning accuracy in order to let certain trades run, because I feel that having those types of trades provides me with a sense of accomplishment.

And finally, are my SIM adjustments too tough?

As I continue to apply my SIM adjustments to the daily trade record, I wonder if I'm being too penalizing to my initial gross figures. One thought that's crossing my mind is whether I just need to trade live again to find out once and for all. Earlier this month, I had to trade live just to see how the real fills will be. But that ended in a mini-disaster, so perhaps I should wait a little longer! In the meantime, I'll just be extra conservative, and will continue to calculate my SIM results as I have been.

Friday, November 18

Total gross profits: $587.50 +11.75 ES points

[SIM adjusted gross profits: $325.00] +6.50

Total trades: 14 [1 scratch, 7 losses]

Accuracy: 42.9%

Contracts per trade: 1

NOTES:

NOTES:An OPEX day that ended on a fizzle. I stopped trading by 2:00 PM when it became slow. But there were enough decent swings earlier in the day that allowed certain trades to run, as well as choppy areas where the DS levels did well to capture scalp trades. Yet another experimentation day, focusing primarily on the whether to use the profit target or not.

No +2.00 profit targets on some trades

Today, I decided to lift the +2.00 profit targets for certain trades that "felt" as though they had room to run. The result? My percentage accuracy went down considerably and overall average profit per trade (expectancy) remained relatively the same as a good scalping day. But the average $'s of winning trades went up considerably. Why? I had a few trades that ran a decent amount. For example, I had one trade go +6.25 and another that went +8.00.

The primary criteria I used when allowing a trade to run was whether it was near the highs/lows of the day, and/or whether it is considered a significant area due to key trendlines. These criteria in confluence with DS levels seem to provide a better than average opportunity for a trade to run beyond a typical scalp.

In this chart to the right, it's clear to see that rationale behind some of the trades were allowed to run without a +2 profit target order.

In this chart to the right, it's clear to see that rationale behind some of the trades were allowed to run without a +2 profit target order.So the question remains, what style works best for me?

Since starting to trade earlier this year, a certain pattern I've tracked is that I am very impatient to enter a trade, but once I'm in a trade, I'm almost too patient to stay on board.

Therefore, I usually don't have the tendency to exit a profitable trade too early, but instead, I tend to overstay my welcome. This works very well on those small percentage of trades that end up running far, but in most instances, I'll let a profitable trade stop me out with a scratch or a small loss.

I believe my ability to hold onto profitable intraday trades is a strength, and so I'll have to factor that into my overall trading strategy. I'm willing to sacrifice winning accuracy in order to let certain trades run, because I feel that having those types of trades provides me with a sense of accomplishment.

And finally, are my SIM adjustments too tough?

As I continue to apply my SIM adjustments to the daily trade record, I wonder if I'm being too penalizing to my initial gross figures. One thought that's crossing my mind is whether I just need to trade live again to find out once and for all. Earlier this month, I had to trade live just to see how the real fills will be. But that ended in a mini-disaster, so perhaps I should wait a little longer! In the meantime, I'll just be extra conservative, and will continue to calculate my SIM results as I have been.

Labels:

recap

Thursday, November 17, 2011

An interesting SIM experience

A very interesting day, to say the least. To begin, it was a day I

probably shouldn't have traded due to a migraine headache, but it was

mild enough for me to overlook some pain in order to experience my

endless fascination with the markets.

The bottom line end results don't reflect my true performance. In general, there's much to feel positive about what I accomplished today.

Thursday, November 17

Total gross profits: -$775.00 (see section below: "TradeStation's SIM was terrible today")